One of the standout qualities of Ladder 7 is their unwavering dedication to my financial well-being.

I have been associated with Ladder 7 since 2019. From the moment I engaged their services, I have known I am in capable hands. Their knowledge, expertise, and dedication to helping me achieve my financial goals have been truly remarkable.

First and foremost, Ladder 7 took the time to understand my financial situation, goals, and aspirations and created a comprehensive financial plan for me. Ladder 7 helped me identify areas where I could optimize my savings, minimize unnecessary expenses, and strategically allocate my resources. Their insights and recommendations are invaluable in maximizing my financial potential.

One of the standout qualities of Ladder 7 is their unwavering dedication to my financial well-being. Their proactive approach ensured that my investments are regularly reviewed and adjusted to align with my evolving objectives.Ladder7 team patiently listens to my all concerns and provides personalized advice tailored to my needs. Whenever I have questions or need guidance, Ladder 7 team is prompt in their responses and always provides clear explanations. Their ability to simplify complex financial concepts and present them in a user-friendly manner is greatly appreciated.One of the standout qualities of Ladder 7 is their unwavering dedication to my financial well-being.

I have been associated with Ladder 7 since 2019. From the moment I engaged their services, I have known I am in capable hands. Their knowledge, expertise, and dedication to helping me achieve my financial goals have been truly remarkable.

First and foremost, Ladder 7 took the time to understand my financial situation, goals, and aspirations and created a comprehensive financial plan for me. Ladder 7 helped me identify areas where I could optimize my savings, minimize unnecessary expenses, and strategically allocate my resources. Their insights and recommendations are invaluable in maximizing my financial potential.

One of the standout qualities of Ladder 7 is their unwavering dedication to my financial well-being. Their proactive approach ensured that my investments are regularly reviewed and adjusted to align with my evolving objectives.

Ladder7 team patiently listens to my all concerns and provides personalized advice tailored to my needs. Whenever I have questions or need guidance, Ladder 7 team is prompt in their responses and always provides clear explanations. Their ability to simplify complex financial concepts and present them in a user-friendly manner is greatly appreciated.

.jpg)

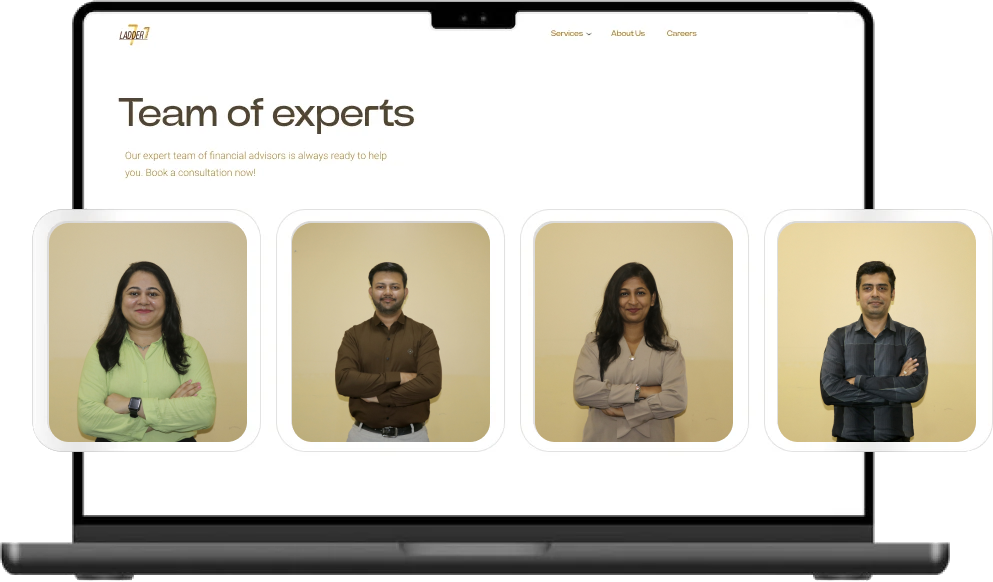

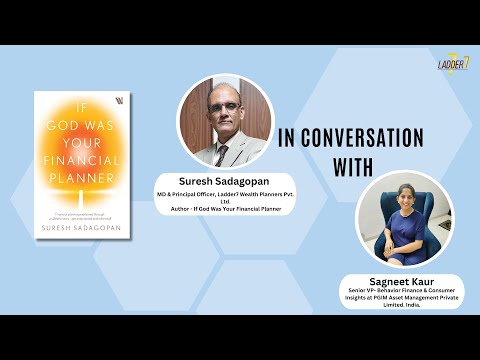

Nidhi Sinha, K S Rao, Amit Trivedi & Suresh Sadagopan

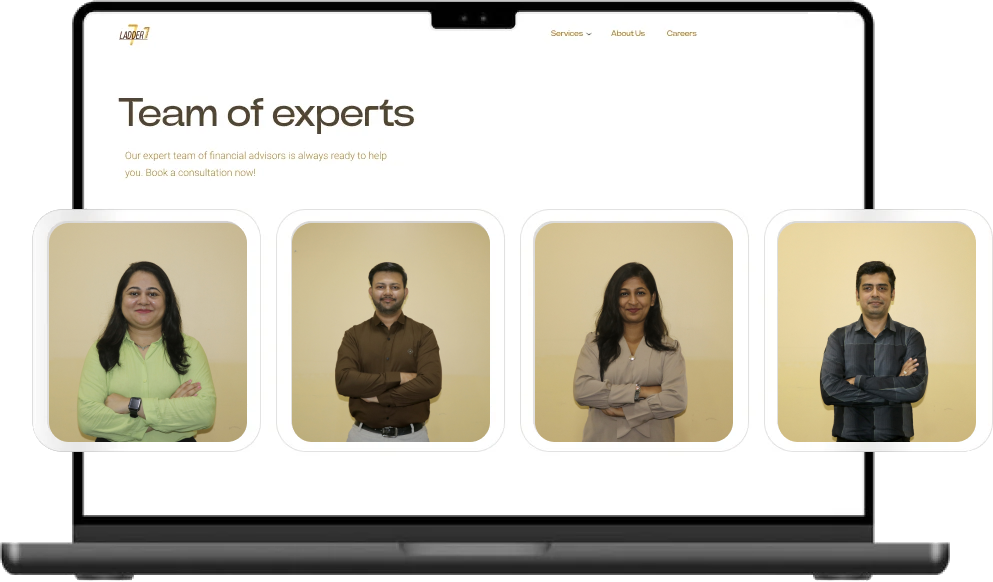

Nidhi Sinha, K S Rao, Amit Trivedi & Suresh Sadagopan